Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. A job cost sheet is prepared when the actual manufacturing costs are known. The information can be recorded in a job cost sheet which serves as a basis for charging stores, manufacturing, and administrative expenses to jobs. R Discuss the treatment of process loss and gains in cost accounting. R Discuss the various methods of valuation of work in process.

What are some advantages of job costing?

A machine costing $5,500, specially brought for this contract, was also sold for $2,000 in December 2019. Of the balance of this account standing on 30 November 2019, $61,500 was in respect of plant and machinery. The respective job accounts showed the following balances in the contract ledger on 30 November 2019. For the remainder of the balance on plant and machinery, $40,000 was used on the job for 8 months and the rest for 6 months. The overtime premium should be charged fully to Job No. 101 if it was a rush job and it was done at the request of the customer.

Which of these is most important for your financial advisor to have?

At its core, process costing is an accounting method tailored to the manufacturing industry. It plays a vital role in offering accurate cost insights, which in turn empowers businesses to make decisions about pricing, analyze profitability, and control costs, ensuring the organization’s financial well-being. Process costing and job costing are methodologies used to determine the cost of products.

Strategic Pricing

Prepare Process Accounts showing cost per ton of each process. The scrap value of the wastages in process X is Rs.8 per 100 units and in process Y is Rs.10 per 100 units. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. We need just a bit more info from you to direct is a wash sale such a bad thing your question to the right person. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Of the former, 50% was transferred to Job No. 202 and the whole of the remaining plant was returned to stores.

Table of Contents

- A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

- It provides comprehensive oversight of your sales cycle, from inception to completion, and adeptly manages your inventory.

- R Discuss the treatment of process loss and gains in cost accounting.

- These raw materials, like fans and vanes, are continuously used throughout the production process, resulting in the creation of identical wind tunnels.

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Process cost accounting is commonly applied when dealing with uniform product units. To better understand its application, let’s consider a hypothetical scenario. Production Overhead is absorbed by processes at a percentage of direct wages. There was no stock of raw materials or work-in-progress at the beginning or at the end of the month. In this article we will discuss about the top five problems on process costing with their relevant solutions.

R State the meaning and treatment of Inter-process proots. Job order costing is a method of accounting for manufacturing costs using a specially designed set of accounts. It is based on the assumption that manufacturing activities are undertaken to fulfill specific customer orders or contracts. Job costing is the method of allocating production costs to specific jobs. Example- Aero Labs manufactures wind tunnel systems designed for use by educators and researchers, including organizations like NASA. Typically, they produce and sell 7-8 wind tunnels annually.

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. The job details shown below were taken from the costing books of a contractor for the month of December 2019. If the overtime premium is fully charged to Job No. 101 but is not completed by 30 November 2019, then the loss on the job will not be included in the account for November 2019.

Job costing is ideal for industries producing unique, custom-made units, whereas process costings caters to sectors with standardized, continuous production. While both systems utilize similar journal entries, process costing is deemed suitable for many industries due to its adaptability. It allows for easy transition to job costing or even a hybrid approach, without significant restructuring of the chart of accounts. In the intricate world of financial accounting, understanding the cost structures of products is paramount. “Process Costings” stands as a beacon for industries that thrive on standardized production. But, like all methodologies, it comes with its own set of challenges that require effective solutions.

This production involves the acquisition of various raw materials, including fans, vanes, base EWT parts, motors, as well as paint and hardware. These raw materials, like fans and vanes, are continuously used throughout the production process, resulting in the creation of identical wind tunnels. For businesses employing process costing, the products are often homogeneous, which means the products are identical or very alike. This homogeneity simplifies the costing process, eliminating the need for individual product cost tracking. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

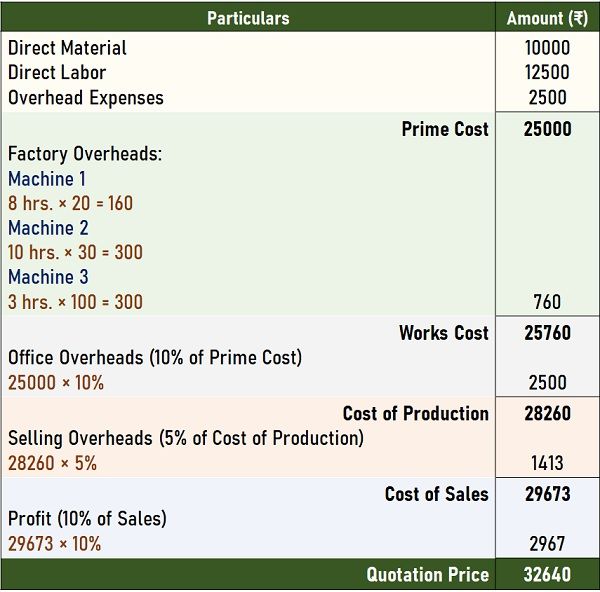

The expenses shown below were incurred for a job during the year ended on 31 March 2019. Simplifies the auditing process and ensures alignment with regulatory mandates.